As a follow up to my previous three articles on Discovery and its various tentacles, this article is a “how did it all play out” follow up to my writings in 2023. To see what they were about, first look at these three articles, then continue reading:

- Discovery Miles and Loyalty in general – aka getting Vitality

- Discovery Vitality – plain and simple

- Discovery Bank – My start and journey in 2023

The beauty of writing this a year later in 2024 is that I now have a much better idea of Discovery, its products, and the big question we see so much in search results:

“Is Discovery Vitality worth it?”

So, is it? My answer is just as before: it depends. So let’s see what those things depend on. I am going to break this down into a few parts, and those are: what I learned in 2023, what I plan to do in 2024, what the alternatives are, and then should you got for it?

What I learned from doing Dicovery Vitality in 2023

Essentially, I will give you the quick TLDR answer up front, and then say why: yes. It was worth it. Economically,

- I earned R15,600 in 2024. Though I only really started earning from May, as that was when I had capacity to really work the system. Context is having a baby, if that helps.

- I spent R3,228 on Discovery Bank fees. Bear in mind, I was paying a similar amount on FNB, so this has disappeared. FNB earned me eBucks, but it got to such a low point, that it was not worth it anymore. Hence the switch.

- I also spent R5,580 on Discovery Vitality. If I was single, this would be cheaper, and we don’t really benefit from the whole family being on it, especially a 1-2 year old who isn’t going to walk around with a smartwatch, even though he probably does 25,000 steps a day!

- So the quick maths there is: R6,826 income. Average of: R569/m.

- However, I want to do a monthly average on May to December, as like I said earlier, Jan-April weren’t the easiest. That total is R663/month – based on eight months.

- Lastly, as that figure is not life-changing, I want to mention that my best month last year gave me R2,262 back in cash, which I can take out as cash, or use to spend on various things.

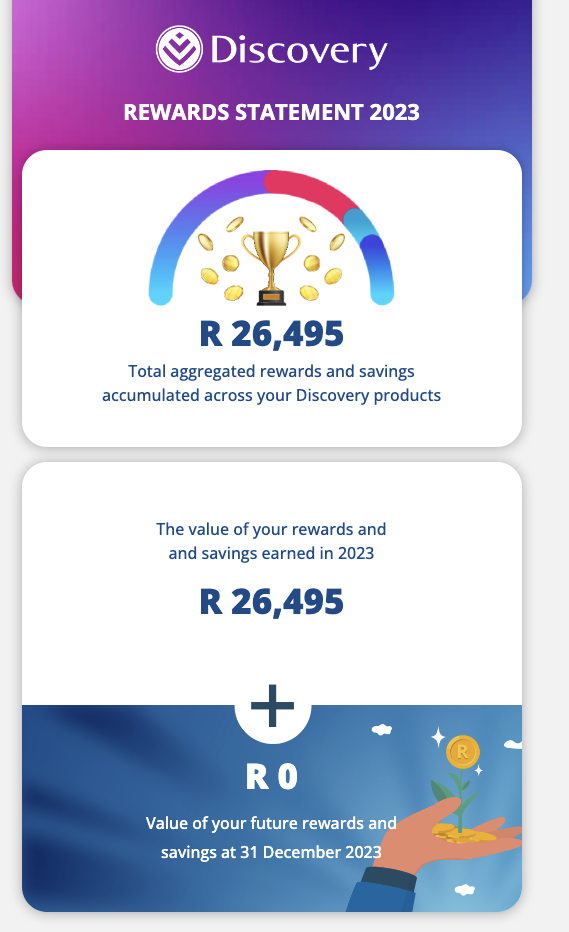

Here is a nice little snapshot of some proof.

What I plan to do with the whole Discovery Suite in 2024?

So this year the main goal is to finish with all the products. It took me a long time to find the time to go through the hassle of moving car and home insurance, and as I knew that once I have had continuous insurance for 3+ years (on my car/home) I could get a better deal, I delayed this a bit. So the 30-40 minutes invested in chatting with a guy on the phone has now happened, and then I took 10 minutes to photograph my car and license disc and upload that, and next is getting the vehicle tracking feature. This is certainly going to up my monthly earnings, and I am going to paste screen grabs on the progress of this in months to come.

Then, secondly, though I need to read the t’s and c’s, I might also use their investing/financial product as I already have Easy Equities, but I’ll have to do my homework. Anyone who has done an hour’s research into investing and such things knows that you really need to save on fees, which is why I keep away from financial advisors, and them taking their cut. That “little” 1% or 3% or what have you, ends up costing you more like 10-25% over 40 years. Not a wise decision.

Thirdly, I plan to move from the Discovery Bank Platinum suite, to the Black suite. I think the change is about an extra R150/m on card fees, but the extra earnings will surely be worth it. The plan is to do it in May/June, once I’ve completed a full year on Platinum. I do like ring-fencing things in years, for better data visualisation and year-on-year comparisons.

What alternatives are out there?

Well, as of writing this, I am not sure another bank can rival Discovery in terms of rewards. A few high earners I know swear by Investec, and that is likely because they have made it so much simpler for them. I thin the flat fee of R500/m and their list of benefits is smaller, and simpler, and for time-pressed folks, that is what they want. “Just give me my airport lounge access, and a flat white” I hear them say.

I signed up for Bank Zero, but feel like they need more time to polish up all their products before I engage with it. I don’t know if that will happen in 2024, and I doubt it for a user like me.

As for the rest. I can’t see ABSA doing anything for consumers, ever. Standard Bank seems on a par with FNB. Tyme Bank is progressive but probably more focused on expanding globally. Capitec isn’t interested in my earning bracket (yet!). Nedbank I don’t think has the personality to innovate… let’s hope I am wrong. And, I can’t think of any others, but I do wish HSBC returns to South Africa.

Should you go for Discovery Vitality in 2024?

At this stage, half my answer is that it’s very much as I said last year in the first article about Vitality, and its pros and cons on joining. But also, the second half of the answer is that in that time frame, though they have improved the offering in slight ways, the things that have left – or gotten worse – is greater than the improvements. Here are some examples:

- When I began, a smoothie was R20, or 200 miles. It changed to R25 or 250 miles late last year, and then became R30 or 300 miles this March 2024. Considering my income, or way of earning miles didn’t go up with such pace, this is a little unfair.

- Last year, until June I think, you could get ‘the iPhone benefit‘ – a sort of “free” phone (a luxury one at that), if you achieve goals etc. At about R20,000 value, this is a huge thing, and now taken away, means I miss out on perhaps something like R10-12,000 of value in a two year cycle, considering I am not going to achieve 40-50% of my goals. Let’s be honest, I don’t want to be a slave to getting 10,000 steps daily, at any cost.

- I am still a bit confused as to the maths behind it, but from the little I can tell, the smartwatch benefit has also dropped. I think my first smartwatch was fully funded (my memory tells me 75%) upfront, based on ticking allt he right boxes, and some exercise goals accomplished. This time round I got 50% off upfront, and I think there is a chance I can get the rest of the 50% off by completing goals, but it’s not certain. It was certainly unclear. I went for a cheap Garmin anyway, so it’s not going to bother me.

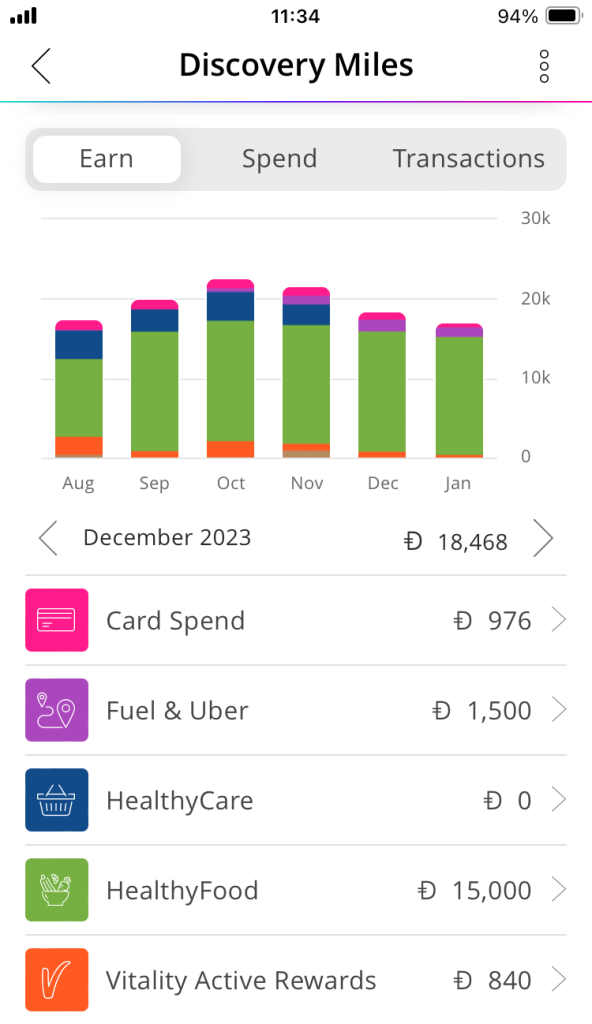

- You may have seen my screengrab above and noticed something – the blue disappears for December and January, and this is because there was an error on Clicks and their “Health” products not counting. It was an error in their side and I got 3-4 months points in a bumper February 2024. Why do I make mention of this? Because the error means I had to jump on their WhatsApp hotline and chat through it with an agent for 10-15minutes of my life. It was worth it as I earned another R1,200 or so because of it, but if too much of this involves my time, it becomes too much. In a similar vein, my bank fees have been wrong once before, and I had to jump on a call, and if you are on the line for more than 5 minutes, you start questioning the process, and valuing your time more. Again, this is still better than FNB (who are great, for the record), and so it’s part and parcel of any bank admin.

- Next, I used Virgin Active for a year, and the saving here of ~R750/m was great for my knee rehab, and swimming. It ends now in April, and means I lose out on those weekly smoothies, and lovely swims. However, I did spend R50 in fuel a week (I’d guess) to get there and back, and am happily returning to the ocean and mountains of Cape Town for a bit.

That benefit, much like airport lounges, and cheap flights, really are an individual thing, and if I fly this year, I’ll be so glad to be on Discovery, if not, then it’s another reason to not bother switching banks and medical aids.

Check back in 3-4 months time and see how March to June progresses, where I should start seeing more Miles earned per month. The goal: to hit R3,000 (30,000 miles) in a month. Wish me luck.

————————————————————————————————————-

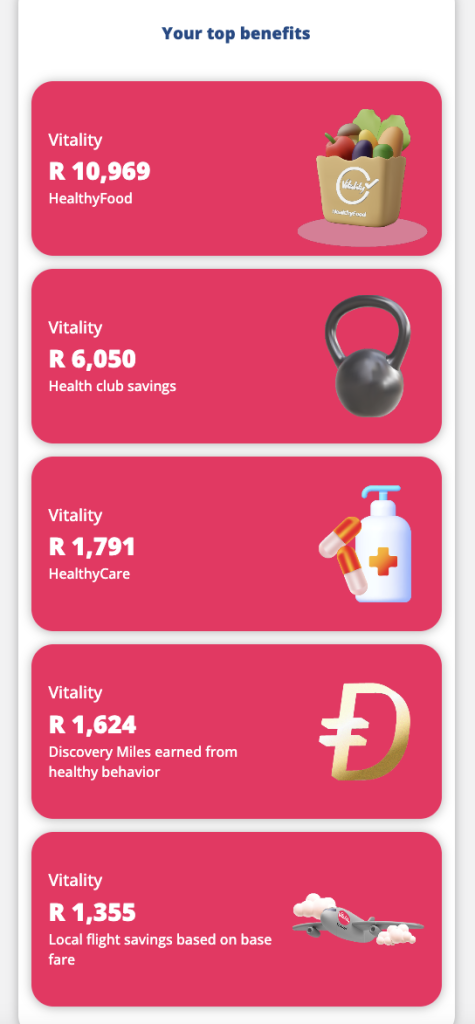

Minor Update: To see how I fared last year, Vitality just sent me (mid-March 2024) a snapshot of my earnings for last year. It summarises the main savings and benefits with a Rand value.